The Benefits of Increasing Dividend Stocks

The information and material contained in this presentation is of a general nature and is intended for educational purposes only. This presentation does not constitute a recommendation or a solicitation or offer of the purchase or sale of securities. Furthermore, this presentation does not endorse or recommend any tax, legal, or investment-related strategy. As with any investment or investment strategy, the outcome depends upon many factors including: investment objectives, income, net worth, tax bracket, risk tolerance, as well as economic and market factors. Before investing or using any strategy, individuals should consult with their tax, legal, or financial advisor. All information contained in this presentation has been derived from sources deemed to be reliable but cannot be guaranteed.

Why Dividends?

A Bird in the Hand It is a common maxim in investing that dividends make up a good portion of the long-term total return in the market. This chart demonstrates how significant that contribution has been over the past century. As the saying goes, “a bird in the hand is worth two in the bush”; the same can be said for the predictability of dividends relative to capital appreciation.

An Established History

At Confluence Investment Management, our value equity investment philosophy was initiated at our predecessor firm and continues to be implemented more than 25 years later. Accordingly, the members of the Value Equities Investment Committee have a long history of managing dividend-oriented investment strategies. With a dedicated team of research analysts conducting proprietary research, the fundamental approach is focused on understanding and valuing individual businesses with an emphasis on owning competitively advantaged businesses. This approach is the foundation of all six domestic value equity strategies at Confluence, including the Increasing Dividend Equity Account (IDEA) strategy.

Increasing Dividend Equity Account (IDEA)

The Confluence IDEA strategy invests in companies with growing dividends, specifically, those that have paid or increased their dividends over the last 10 years.

The initial security screen for the IDEA portfolio looks for consistent, growing dividends, considering these factors:

Consecutive dividends paid over the last 10 years

No dividend reductions in the last 10 years

Dividend raised in 7 of the last 10 years

Dividend yield greater than 1%

This criteria helps identify high-quality companies with stable and growing cash flow and moderate-to-low levels of debt. Confluence’s investment philosophy builds upon the required criteria established to create the initial IDEA investable universe. Stocks selected for the strategy are diversified across industries and market capitalizations, avoiding excess concentrations in particular industries. These companies typically have well-positioned business models, ones that can grow during economic expansions and persevere through recessions and industry downturns. Valuations play an important role, as we believe avoiding excessive valuations is a key metric in managing risk.

Stocks with Growing Dividends Provide Income & Outperform Over the Long Term

Since its inception, the Confluence Increasing Dividend Equity Account (IDEA) strategy has focused not just on dividends, but growing dividends. While that distinction might seem minor, in reality, it is quite significant.

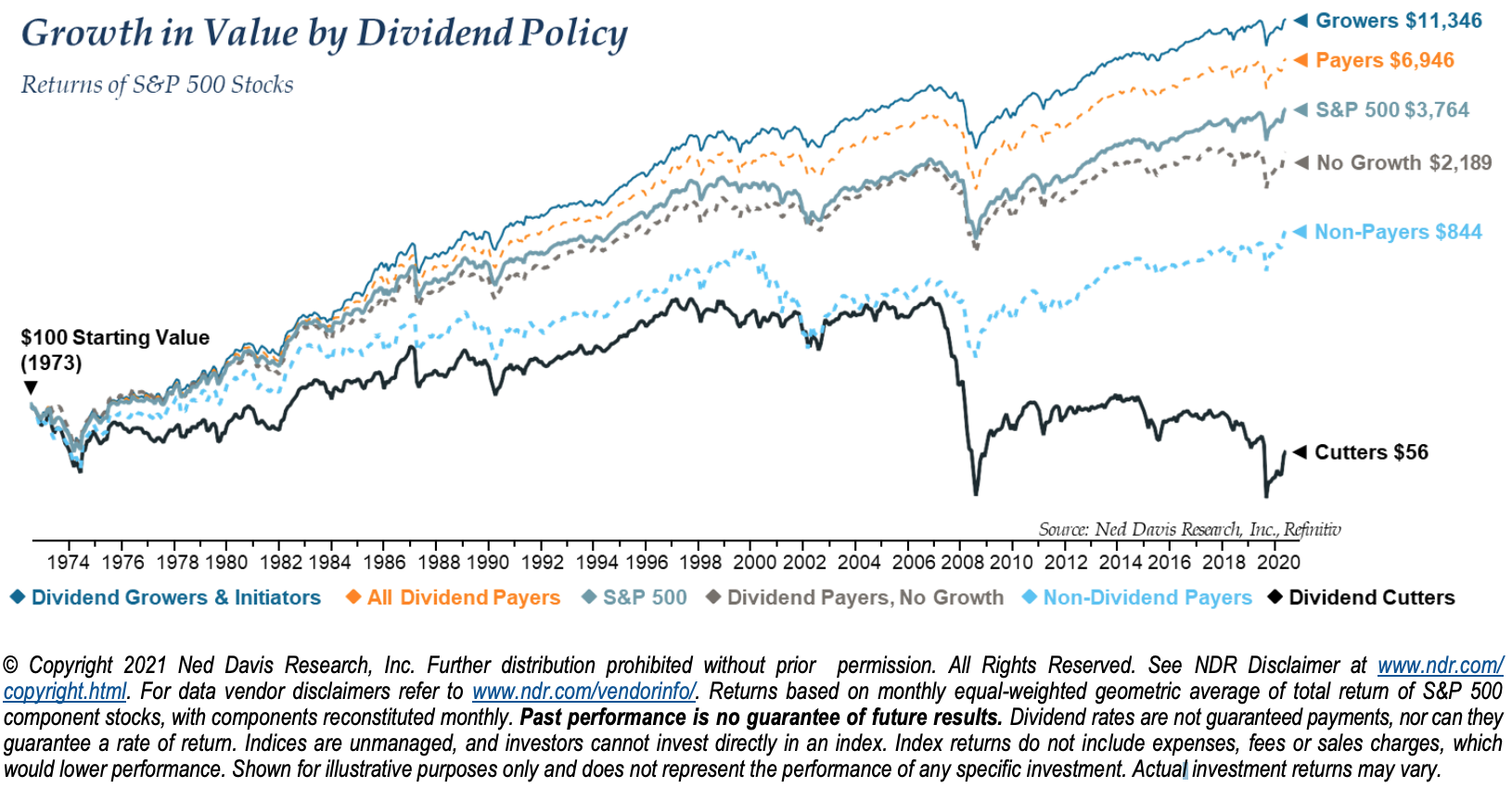

As the chart below displays, a $100 portfolio invested in dividend growers starting in 1973 (when the dataset begins) would be worth $11,346 at the end of 2020, substantially outperforming the S&P 500 at $3,764 and dividend nongrowers (those who paid dividends but did not increase) at $2,189.

Why Do Certain Dividend Growers Outperform?

This question gets to the core of the IDEA strategy. Dividend-growing stocks have historically outperformed over the long term because they tend to be higher-quality companies. Growing dividends are a byproduct of this quality, not the source.

These higher-quality companies with consistent dividend growth often possess many of the following attributes:

Sustainable competitive advantages that enable high returns on invested capital;

Less capital intensive and less cyclical;

Lower debt leverage and growing free cash flow that can be used to grow the business, repurchase shares, and pay dividends.

Overall, a growing dividend is not a secret formula that makes a stock go up, but rather it is a reflection of the aforementioned business attributes that have enabled the consistent, long-term dividend growth. Furthermore, when purchased at reasonable valuations, these attributes lead investors to high-quality companies that can compound over decades. When this philosophy is applied in a disciplined manner using established criteria, as Confluence does in the IDEA strategy, the result is a diversified portfolio of high-quality companies operating stable businesses from which they can offer the prospect of rising dividends to shareholders.

Do All Dividend Growers Outperform?

The short answer is no. There are some stocks with growing dividends that are lower-quality companies where dividend growth may be unsustainable. While a historical track record of growing cash flow and dividends is an important indicator, fundamental analysis is needed to determine if a company’s dividend will continue to grow in the future.

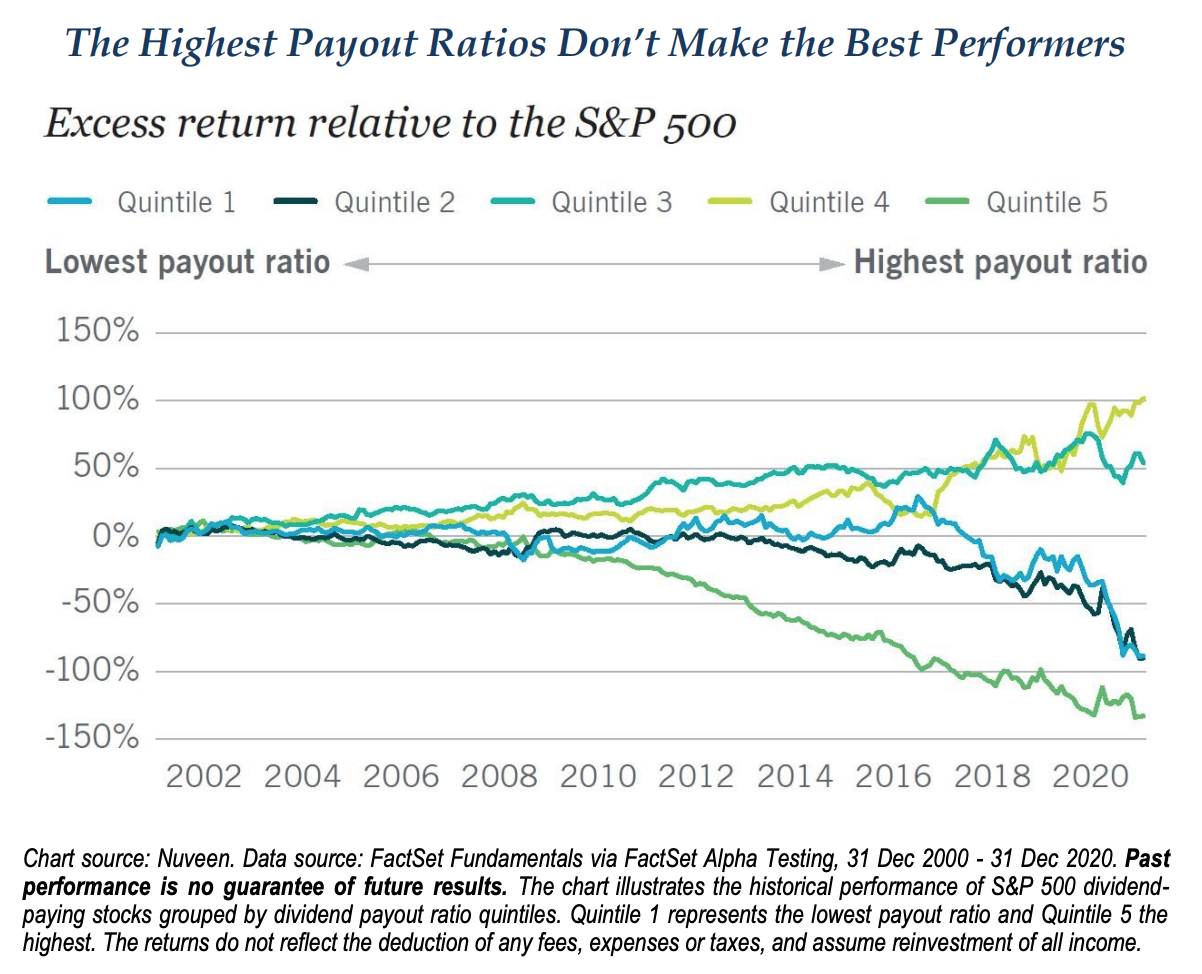

Confluence has a deep team of experienced investment professionals dedicated to a disciplined investment process. The Value Equities Investment Committee performs fundamental research to understand the underlying business drivers that could impact the payout ratio and constrain the company’s ability to grow the dividend. A payout ratio is used to compare the current dividend to the core earnings produced by the company. So, a payout ratio of 100% indicates that all earnings are already being paid out as dividends, while a 0% ratio indicates that no dividends are being paid.

As this chart shows, the sweet spot in the middle (the 40th-80th percentile, or quintiles 3 and 4) has historically produced the best overall investment results.

While good management is key to a successful business, having capital management that is focused on dividend growth is not sufficient if the business fundamentals can’t keep up. In-depth business analysis along with metrics like the payout ratio are good barometers for evaluating sustainable dividend growth.

What About Inflation & Its Impact on Dividend Stocks?

In an environment of low interest rates and concerns about inflation, it is important to understand how inflation will impact dividend-paying stocks. Dividend-paying stocks with high yields and stagnant business fundamentals tend to act like bonds, rising when interest rates fall and falling when interest rates rise. As a result, sustained inflation that causes higher interest rates could severely impact these high-yield dividend stocks, so investors should be cautious.

Fortunately, dividend growers are not destined to trade like bonds. The same business attributes that cause these highquality companies to outperform over the long term should also help them grow and keep up with inflation. For example, a dividend grower like Starbucks (SBUX) has a high return on capital, minimal capital needs, and the ability to raise prices to offset inflation, whereas a regulated utility usually lacks most of those attributes and trades at a high dividend yield to compensate for little to no growth.

As the table below displays, dividend growers have been able to outperform across different inflationary environments, including periods of high inflation when dividend growers returned 8.1% versus the S&P 500 at 6.7% and companies with unchanged dividends at 5.8%. This indicates that these high-quality business attributes that support a growing dividend can help offset headwinds from elevated inflation and rising interest rates.

Overall, there are many benefits to increasing dividends and our intention with this report is to offer a helpful breakdown of the various components. While the concept of owning dividend growers may seem fairly straightforward, we believe that identifying and holding onto the most high-quality ones at reasonable valuations is critical to long-term success.