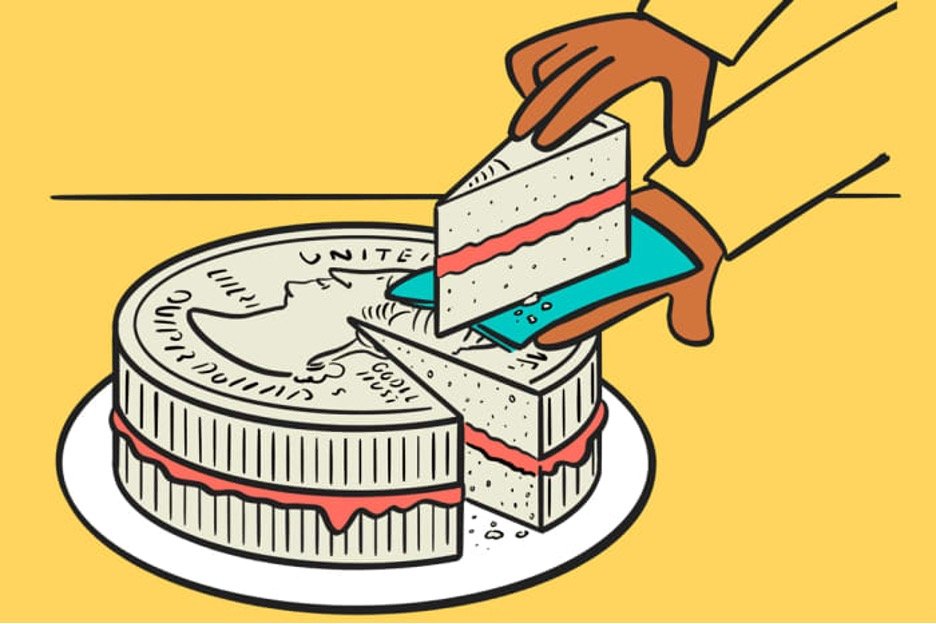

Decumulation Dilemma: Navigating Finances for Baby Boomers

Retiring Baby Boomers are changing from saving for retirement to using their savings for income during retirement. Since 2013/2014, more money has been withdrawn from 401(k) plans than going contributions in. This trend is expected to continue until 2030, with a peak of $40 billion per year in 2019.

Many people nearing retirement are unsure about managing their money for turning savings into income. Financial advisors frequently emphasize the challenge of conveying the crucial link between assets, income, and retirement objectives. There's a growing realization that, given longer lifespans and a prolonged period of low interest rates, there might be a disparity between expected retirement income and what current savings can actually generate.

Retirees Spending in line with Income

If retirees aren't aggressively drawing down their assets, what are their primary sources of income? Apart from retirement savings, retirees generally rely on four main income sources: labor, capital gains, pensions, and Social Security. Social Security tends to contribute the most across different wealth groups.

After retirement, income levels usually stay the same or slightly decrease over time. After taxes, you will receive about 60 to 70% of your pre-retirement income as a replacement. People typically spend slightly less than they earn, and the richest group tends to reduce their spending the most over time.

Wealthy and middle groups can find relief in investment portfolios' capital appreciation. From 1992 to 2015, a portfolio with 20% stocks and 80% bonds had an average yearly return of 6.6%. Another portfolio with 60% stocks and 40% bonds had an average yearly return of 8.0%.

Accessing these appreciated assets could help bridge any income shortfall without significantly depleting the principal. Retirees often live comfortably by adjusting spending according to income, which helps them save their money.

Looking Back: Most Didn't Need or Want to spend Savings

According to a study by Blackrock Retirement Institute in conjunction with the Employee Benefit Research Institute, retirees did not spend money for nearly 20 years. Instead, they depended on alternative sources of income.

Many individuals had the option to withdraw additional funds from their retirement accounts but decided against it. As a result, a significant portion of their savings remained untouched.

Strong biases in behavior, like lack of confidence and reluctance to use savings, may have affected their actions. These biases are deeply ingrained and have a significant impact on their behavior.

One example of such bias is low self-assurance, which can lead to hesitation and indecisiveness. Another bias is the unwillingness to use their savings, which can result in missed opportunities and limited financial growth. These biases play a crucial role in shaping their actions and decision-making processes.

According to a survey conducted by BlackRock, only 36% of Americans feel confident about their retirement savings. On the other hand, a majority of 55% express concerns about depleting their savings.

Lack of guidance and planning can significantly impact the next generation's financial stability. Without proper guidance, fears and lack of planning can hinder their ability to earn enough money. This, in turn, may prevent them from maintaining a stable lifestyle.

Looking Forward: More Challenging Environment

Retirees in the 1990s and 2000s had favorable conditions for a comfortable retirement without depleting their savings. However, looking forward, future retirees might not have the same advantages.

In retirement, individuals may encounter various challenges. These challenges may necessitate the need for increased savings and maximizing their retirement funds, including the initial amount. But if they don't want to change their retirement lifestyle, they might have to deal with these problems.

In the future, we anticipate facing various challenges. Some challenges are less money from investments, smaller pensions, decreased Social Security benefits, and longer lifespans. These structural and societal uncertainties, coupled with inherent behavioral obstacles in retirement spending, point toward a complex and demanding landscape in the upcoming decades.

Decumulation in Retirement

For upcoming retirees, longevity without substantial guaranteed retirement income beyond Social Security emphasizes the critical need for establishing dependable lifelong income sources. However, the process of systematically drawing down assets is intricate.

According to Transamerica's research, almost half of American workers have estimated their retirement savings needs. This is twice as common as any other response. This uncertainty makes them vulnerable. They may use up their money too quickly or not spend it at all because they're afraid of running out.

This underscores the significance of investors proactively focusing on their future retirement income objectives and expenditure necessities well before retirement. It's essential to strategize ways to optimize the income-generating potential of their hard-earned retirement savings alongside their anticipated Social Security benefits.

Optimizing Retirement Income Solutions

Stanford Center on Longevity studied how investors can combine investments and insurance to achieve different retirement income goals. They compared systematic withdrawal plans (SWPs) from investment portfolios with basic annuities based on several criteria:

Income amount

Savings accessibility

Pre- and post-retirement security

Protection against inflation

Lifetime assurance

Research shows deferred annuities generally offer higher annual income compared to withdrawing money from investments, purely in financial terms. However, considering behavioral aspects, particularly regarding access to savings, relying entirely on deferred annuities, or heavily favoring them, might not be optimal for most individuals.

The report recommends using retirement savings to purchase a deferred annuity. This deferred annuity could provide guaranteed income, in addition to Social Security, to cover essential expenses. The remaining retirement savings could then be managed through systematic withdrawal plans to address discretionary spending.

Furthermore, the report highlights safeguarding assets from market downturns during the crucial five to ten years before retirement. It advises investors to mitigate equity risk in their portfolios and consider acquiring deferred annuities for added protection.

Bottom Line

Navigating retirement and managing funds for long-term financial security is a multifaceted endeavor, marked by shifting paradigms and evolving challenges. As the Baby Boomer generation transitions from accumulation to utilization of savings, profound insights emerge about income sources and spending behaviors during retirement. It is important to have reliable income sources other than Social Security for life. This shows the need for planning and new ideas for retirement income.

Sources:

Disclosures:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This site may contain links to articles or other information that may be on a third-party website. Advisory Services Network, LLC is not responsible for and does not control, adopt, or endorse any content contained on any third-party website.

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.