Financial Advisors in Raleigh NC: Financial Tips on Life Insurance

September is Life Insurance Awareness Month. Most Americans recognize the importance of life insurance: About 70% of Americans say that they need coverage, and the number of people who intend to buy a policy has reached all-time highs during the pandemic.

But even though plenty of people understand the value of life insurance, there’s still a big gap between how many need coverage and how many actually have it. That’s why Life Insurance Awareness Month exists. Occurring in the month of September, Life Insurance Awareness Month is designed to educate people about life insurance and help them make the right coverage choices.

What is Life Insurance?

Life insurance is a powerful tool for many different financial situations. Here are a few reasons why you might buy a life insurance policy:

Others depend on your income or care. If you earn money for your family, you may want to make plans to replace that income should you die. Even if you’re a stay-at-home parent performing work that doesn’t generate income, your work has value and can be insured.

Your estate won’t cover final expenses. Even if you don’t have dependents, an insurance policy can be useful if it covers final costs, such as funeral expenses, which protects your next of kin from a financial burden.

Employer-provided insurance may not be enough. Your employer may offer a low-cost or free basic life insurance policy as well as a supplemental policy. These policies can be useful but are often not enough for workers with dependents, as they typically represent only one or two years of income.

You’re young and healthy. Youth and a clean bill of health are often justifications for not being insured. However buying a plan when you’re younger and a lower health risk may help you qualify for lower premiums. Starting out with low premiums can be particularly useful when you buy a policy with a renewable clause, which allows you to re-up your coverage without a new medical exam. That way, new health problems won’t increase the amount you pay.

You want to leave more to your heirs. If you’re interested in leaving a financial legacy, a life insurance policy may help you maximize the size of your estate and reduce potential tax bills for your heirs.

What should I look for in a policy?

Always compare multiple policies when shopping for life insurance. Here are several things to keep in mind:

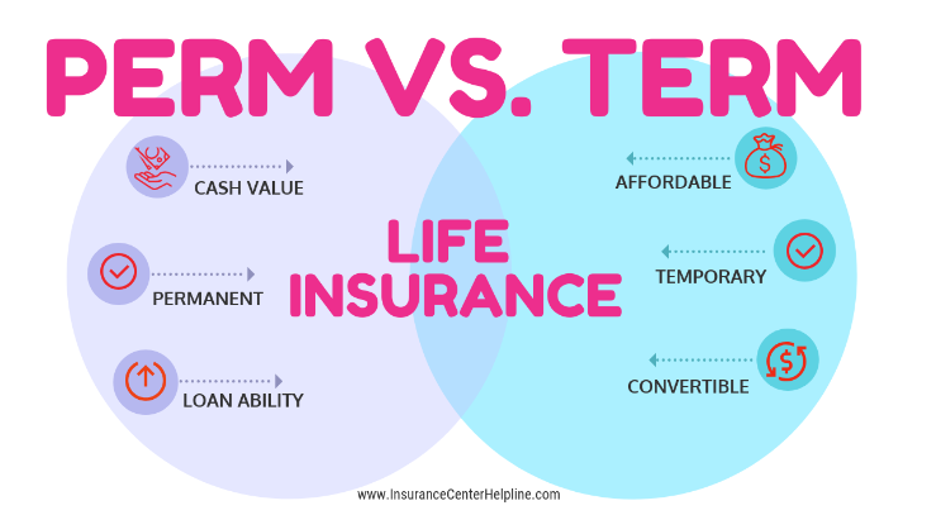

Consider both term and permanent life insurance. A term life insurance policy covers you for an agreed-upon period of time, whereas a permanent life insurance policy covers you for the rest of your life. Many permanent policies include a savings component. In some cases, the policy owner can borrow against this cash value or withdraw money to help cover certain expenses, such as a child’s education.

Compare premiums and size of coverage. Your needs will determine your size of coverage. For example, perhaps you’re looking for a policy that will cover 10 years’ worth of income or simply pay off the balance of your mortgage. When you compare premiums, find out whether the premiums are guaranteed to remain the same or will increase over the term of the policy.

Compare the length of coverage. For term life insurance policies, coverage lasts a set amount of time, usually between 10 and 30 years. How long you need your term policy may depend on your financial obligations. You may want to be covered until your children are out of the house or until your mortgage is paid off, for example.

Find out what happens if you get sick. Some policies allow you to receive “accelerated death benefits” if you are diagnosed with a terminal illness. Accelerated death benefits are paid to you directly to spend how you like. Whatever balance you leave in the policy is paid as normal after your death.

Have confidence in the insurer. An insurance policy is only as reliable as the company underwriting it. Ask any prospective insurer to see the ratings they’ve been given by independent groups, such as AM Best, to see whether you feel comfortable entering into a contract with them.

Permanent and Term Life Insurance

There are two primary types of life insurance: term and permanent life. Permanent life insurance such as whole life insurance or universal life insurance can provide lifetime coverage, while term life insurance provides protection for a certain period.

Advantages of Permanent Life Insurance

Permanent life insurance policies that have an investment component allow you to grow wealth on a tax-deferred basis. This means you don’t pay taxes on any interest, dividends, or capital gains on the cash-value component of your life insurance policy until you withdraw the proceeds.

Another touted benefit of permanent life insurance is that you don’t lose your coverage after a set number of years. A term policy ends when you reach the end of your term, which for many policyholders is in their 60s, while permanent policies can cover you for life.

If you need money to buy a home or pay for college, you can borrow against the cash value of a permanent life insurance policy.

Disadvantages of Permanent Life Insurance

While permanent life insurance can yield several benefits, there are some potential downsides to keep in mind. Cost is one of the most important. Compared to term life insurance policies, permanent life insurance can require you to pay higher premiums. If it turns out that you don't need insurance coverage for life, you may be paying premiums unnecessarily.

Advantages of Term Life Insurance

Term life is generally less expensive to purchase compared to permanent life insurance. That's because the insurance company assumes less risk since you're only insured for a set time period. The younger and healthier you are when you buy a term life policy, the lower your premiums are likely to be.

One advantage of term life insurance is that you can choose how long you want to be covered. So if you think you'll only need life insurance for 10 years or 20 years, you can choose a term that matches up with your needs.

Disadvantages of Term Life Insurance

When you buy a term policy, all of your premiums go toward securing a death benefit for your beneficiaries. Term life insurance, unlike permanent life insurance, does not have any cash value and therefore does not have any investment component.

If you're still alive when the term ends, the policy simply lapses, and you and your beneficiaries don't see any money.

Bottom Line

In general, the benefits of buying life insurance outweigh the disadvantages. Life insurance can help protect your family in case of an early demise and is a steady savings vehicle for retirement. However, there are various policies available, and not every policy fits everyone’s unique financial situation. That is why it is essential to understand your options and work with a financial advisor or financial planner that you trust to find a suitable policy.

https://smartasset.com/life-insurance/benefits-of-life-insurance

https://www.investopedia.com/terms/l/lifeinsurance.asp

https://www.policygenius.com/life-insurance/what-are-the-advantages-and-disadvantages-of-life-insurance/

https://www.moneygeek.com/insurance/life/whole-life-insurance/

https://lifehappens.org/about/campaigns/

Disclosures:

Life Insurance Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

This site may contain links to articles or other information that may be on a third-party website. Advisory Services Network, LLC is not responsible for and does not control, adopt, or endorse any content contained on any third-party website.