Guide to Retirement Planning by Financial Advisors in Raleigh, NC

As financial advisors in Raleigh, NC we often discuss retirement planning and explain the different retirement accounts and how valuable of an asset they are in financial planning. Retirement accounts exist to manage and grow your money over time so when you reach the retirement milestone, you have income to sustain you throughout your non-working years.

Just like embarking on your chosen career path is a major life milestone, the consummation of that path can be just as exciting and significant to your future. However, if you haven’t been planning for your retirement over the course of your career, you will likely be finding yourself sticking around a lot longer than you had originally pictured.

There are a vast array of retirement savings vehicles available to consumers. Which plan you should invest your money into depends on your unique situation and your financial end goals. The key to successful retirement plans is to consider the lifestyle you want to have, anticipate the needs of that lifestyle, and set a financial goal to achieve it.

If you are new to retirement planning, the options can be overwhelming enough to make your head spin. If you have a working knowledge of the various retirement savings vehicles but perhaps are in need of a refresher course, we can help break it all down for you. Below we will define the different types of retirement plans and discuss the advantages and disadvantages of each.

Individual Retirement Accounts/IRAs

An Individual Retirement Account, or IRA, is a valuable retirement plan created by the U.S. government to help workers save for retirement. Individuals can contribute up to $6,000 to an account in 2022, and workers over age 50 can contribute up to $7,000.

There are many kinds of IRAs, including a traditional IRA, Roth IRA, spousal IRA, rollover IRA, SEP IRA and SIMPLE IRA.

Traditional IRAs

A traditional IRA is a tax-advantaged plan that allows you significant tax breaks while you save for retirement. Anyone who earns money by working can contribute to the plan with pre-tax dollars, meaning any contributions are not taxable income. The IRA allows these contributions to grow tax-free until the account holder withdraws them at retirement and they become taxable. Earlier withdrawals may leave the employee subject to additional taxes and penalties.

Roth IRAs

A Roth IRA is a newer take on a traditional IRA, and it offers substantial tax benefits. Contributions to a Roth IRA are made with after-tax money, meaning you’ve paid taxes on money that goes into the account. In exchange, you won’t have to pay tax on any contributions and earnings that come out of the account at retirement.

A Roth IRA is an excellent choice for its huge tax advantages. It is also an excellent choice if you’re able to grow your earnings for retirement and keep the taxman from touching it again.

Employment Retirement Accounts

Employer-sponsored plans for retirement are just that: savings vehicles provided by your employer. The most popular options offered by for-profit companies are traditional 401(k)s and Roth 401(k)s (with potential employer match). For nonprofits, a popular option is a 403(b) and for government employees a thrift savings plan.

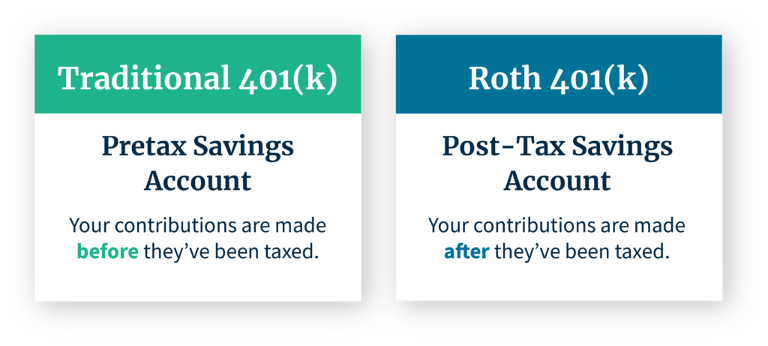

Traditional 401(k)

A 401(k) plan is a tax-advantaged plan that offers a way to save for retirement. With a traditional 401(k) an employee contributes to the plan with pre-tax wages, meaning contributions are not considered taxable income. The 401(k) plan allows these contributions to grow tax-free until they’re withdrawn at retirement. At retirement, distributions create a taxable gain, though withdrawals before age 59 ½ may be subject to taxes and additional penalties.

Roth 401(k)

With a Roth 401(k) an employee contributes after-tax dollars and gains are not taxed as long as they are withdrawn after age 59 1/2.

403(b)

A 403(b) plan is much the same as a 401(k) plan, but it’s offered by public schools, charities and some churches, among others. The employee contributes pre-tax money to the plan, so contributions are not considered taxable income, and these funds can grow tax-free until retirement. At retirement, withdrawals are treated as ordinary income, and distributions before age 59 ½ may create additional taxes and penalties.

Similar to the Roth 401(k), a Roth 403(b) allows you to save after-tax funds and withdraw them tax-free in retirement.

Thrift Savings Plans

The Thrift Savings Plan (TSP) is a lot like a 401(k) plan on steroids, and it’s available to government workers and members of the uniformed services.

Participants choose from five low-cost investment options. The options include a bond fund, an S&P 500 index fund, a small-cap fund and an international stock fund, plus a fund that invests in specially issued Treasury securities.

On top of that, federal workers can choose from among several lifecycle funds with different target retirement dates that invest in those core funds, making investment decisions relatively easy.

Self Employed Retirement Accounts

There are a variety of retirement plans available for self-employed individuals. The self-employed are eligible for the traditional and Roth IRAs, but they also have access to several alternative savings vehicles.

Solo 401(k) or Solo Roth 401(k)

Alternatively known as a Solo-k, Uni-k and One-participant k, the Solo 401(k) plan is designed for a business owner and his or her spouse.

Because the business owner is both the employer and employee, elective deferrals of up to $20,500 can be made. A non-elective contribution of up to 25 percent of compensation, up to a total annual contribution of $61,000 for businesses, not including catch up contributions.

SEP IRA

The SEP IRA is set up like a traditional IRA, but for small business owners and their employees. Only the employer can contribute to this plan, and contributions go into a SEP IRA for each employee rather than a trust fund. Self-employed individuals can also set up a SEP IRA.

Contribution limits in 2022 are 25 percent of compensation or $61,000, whichever is less. Figuring out contribution limits for self-employed individuals is a bit more complicated.

Account holders are still tasked with making investment decisions. Resist the temptation to break open the account early. If you tap the money before age 59 ½, you’ll likely have to pay a 10 percent penalty on top of income tax.

SIMPLE IRA

With 401(k) plans, employers have to pass several nondiscrimination tests each year to make sure that highly compensated workers aren’t contributing too much to the plan, relative to the rank-and-file.

The SIMPLE IRA bypasses those requirements because the same benefits are provided to all employees. The employer has a choice of whether to contribute a 3 percent match or make a 2 percent non-elective contribution even if the employee saves nothing in his or her own SIMPLE IRA.

Defined Benefit Plan

Traditional pensions are a type of defined benefit (DB) plan, and they are one of the easiest to manage because so little is required of you as an employee.

Pensions are fully funded by employers and provide a fixed monthly benefit to workers at retirement. But DB plans are on the endangered species list because fewer companies are offering them. Just 14 percent of Fortune 500 companies enticed new workers with pension plans in 2019, down from 59 percent in 1998, according to data from Willis Towers Watson.

Why? Defined benefit plans require the employer to make good on an expensive promise to fund a hefty sum for your retirement. Pensions, which are payable for life, usually replace a percentage of your pay based on your tenure and salary.

Understanding all the options available to you can be overwhelming. Let the experts at Olde Raleigh Financial help you choose the best retirement plans to get you positioned for success in reaching that milestone.

Disclosure:

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.

Advisory Services Network, LLC does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state laws are complex and constantly changing. You should always consult your own legal or tax professional for information concerning your individual situation.

https://www.irs.gov/retirement-plans/pla...

https://www.dol.gov/general/topic/retire...

https://www.forbes.com/advisor/retiremen...

https://www.nerdwallet.com/article/inves.

https://www.investopedia.com/articles/retirement/08/best-plan.asp