New 2026 Law May Make Small Business Owners Vulnerable

February 3, 2026

In 2026, many small business owners face a growing challenge—and it’s not cash flow or competition. The real threat is finding out too late that key financial or legal rules have already changed.

Small businesses often rely on old agreements, past policies, and habits that used to work well. This is different from large corporations that have teams for compliance and legal issues. When tax codes, employment laws, or financial rules change, old systems can become weak spots that hurt your profits.

Why Staying Compliant Matters More Than Ever

Whether your business manages employees, independent contractors, or vendor relationships, keeping your financial and legal agreements current is essential to avoiding costly mistakes. Old contracts or informal agreements can cause penalties, disputes, or even loss of important business relationships. These issues can lead to financial problems.

As a trusted financial advisor, we’ve seen how quickly overlooked compliance details can snowball into major setbacks. Let’s look at where small businesses typically face the greatest exposure.

Common Risk Areas for Small Businesses

1. Outdated Contracts and Agreements

Changes in business or tax law can affect the enforceability of your existing contracts. For example:

● Employment contracts that no longer align with updated wage, classification, or benefits regulations.

● Vendor agreements that lock you into unfavorable terms due to inflation or market changes.

● Clauses that are now limited or invalid under new legislation.

Even a well-written contract can cause trouble if it hasn’t been reviewed in light of recent legal or financial updates.

2. Informal Business Practices

Many small businesses rely on informal arrangements—like verbal agreements with contractors or flexible pay and scheduling practices. While these may have worked in the past, new laws often demand documentation. Without it, an otherwise honest practice could appear noncompliant or unfair under current standards.

3. Financial Disputes Rooted in Misunderstanding

Most disputes aren’t the result of bad intent—they happen when one side simply didn’t realize the law changed. A client may challenge a fee, an employee could question classification, or a vendor might dispute updated costs. Whatever the case, a lack of timely revisions can put your finances and reputation at risk.

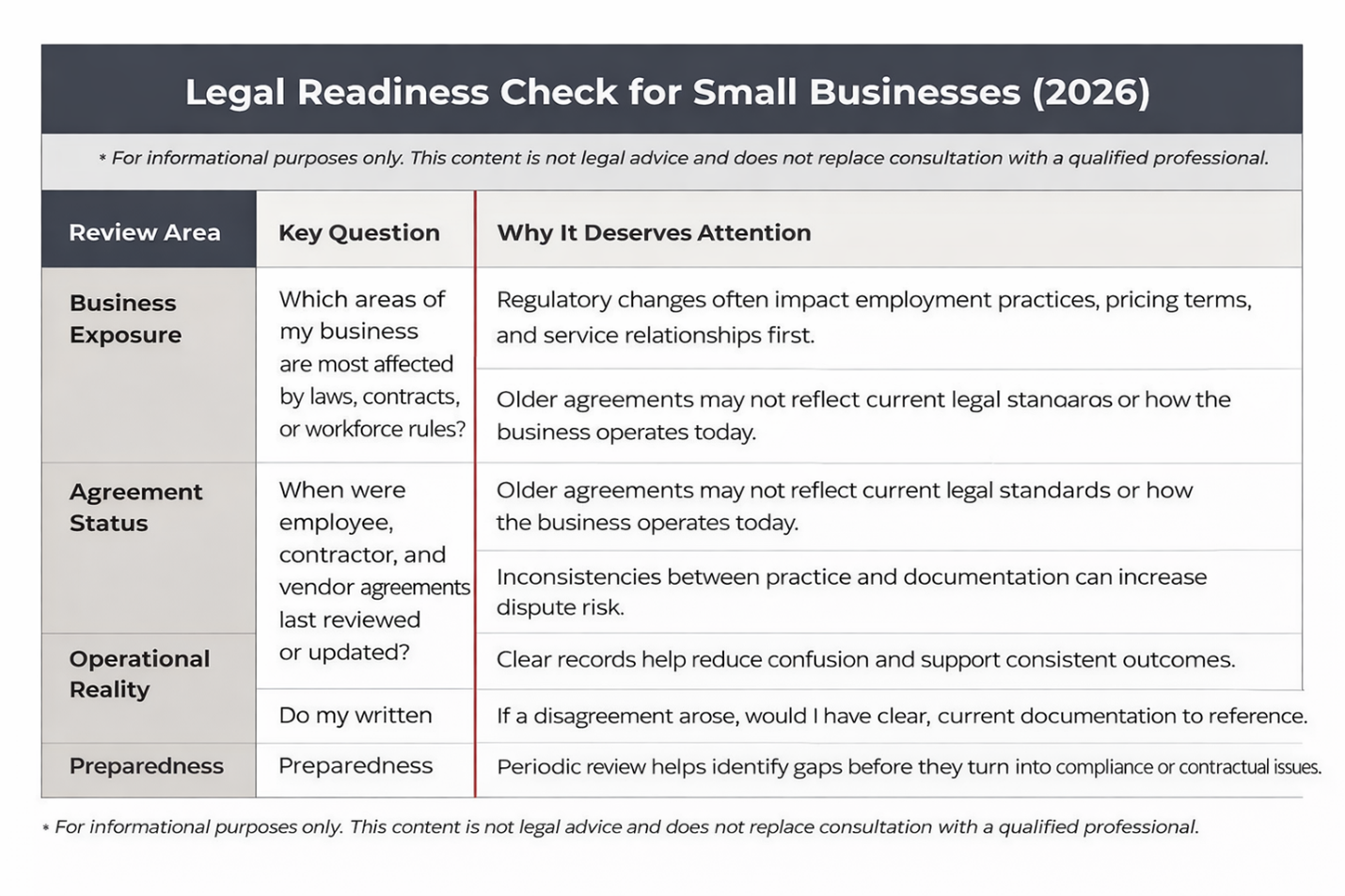

Four Questions Every Business Owner Should Consider

Before assuming your business risk, take a moment to assess your risk profile:

1. Where am I most exposed? Which areas of my business depend on contracts, financial agreements, or regulated practices?

2. Are my agreements current? When was the last time I reviewed key employee, contractor, or vendor contracts?

3. Do my records match reality? If a dispute arose tomorrow, could you prove how your business actually operates?

4. Have I done a compliance checkup recently? Have you evaluated your policies or practices since new laws took effect in 2026?

Asking these questions helps you spot vulnerabilities early—before they become financial crises.

Smart Steps to Help Manage Risk

Proactive business owners may not need to overhaul everything. Small, focused steps can make a big difference:

● Review critical documents: Start with high-impact contracts—employment, vendor, and partnership agreements.

● Align practice with paperwork: Make sure your written policies reflect how your business actually functions today.

● Identify gaps quickly: Look for inconsistencies between contracts and everyday operations, especially related to pay, billing, or service terms.

● Partner with professionals: Work with your financial advisor and legal counsel to help ensure compliance before issues arise.

Final Thought

Legal and financial compliance in 2026 isn’t just about following every rule. It’s about understanding your business's position and identifying potential risks. By reviewing your contracts, setting key practices, and planning a financial checkup, you stay current. This helps protect your business and the clients who depend on it.

Sources:

Disclosure:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This material is provided as a courtesy and for educational purposes only.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.