Raleigh NC Financial Advisor: IRA Rollovers

A rollover IRA can be a great option for money in old retirement accounts. To avoid a tax hit, do it the right way.

As financial advisors, it is common for us to meet with a client who has several different 401(k)'s still held with previous employers.

The process of moving existing retirement funds from one plan to another is referred to either a rollover or transfer. There are specific IRS rules that govern what types of funds can be moved between various plans and the methods of executing and reporting on fund movement.

Generally speaking, you can move funds from one plan to another and still retain the tax-sheltered status of the funds. Most clients establishing a self-directed IRA or Solo 401(k) will initially fund their new plan with a non-taxable transfer or rollover from an existing plan. There are 3 common methods of moving funds between plans.

What is a Rollover IRA?

A rollover IRA is an account that allows you to transfer a former employer-sponsored retirement plan into another IRA. Most rollovers happen when people leave a job and want to transfer funds from their 401(k) or 403(b) account into an IRA, but it can also apply to most any pension or workplace plan.

When you roll over your IRA, you avoid early withdrawal penalties (if you're under 59 ½) and maintain the tax-deferred status of your assets. That means they'll continue to grow in the account tax free.

What's more, you'll likely end up with a broader range of investment options and lower fees than you had with the 401(k).

Any type of IRA can be a rollover IRA. You can set up a new account or use an IRA you already own. If it's the latter, for this one deposit you aren't bound by the usual annual IRA contribution limits: You can invest the total amount of your old account.

Understanding IRA Rollovers

IRA rollovers can occur from a retirement account, such as a 401(k) into an IRA, or as an IRA-to-IRA transfer. Most rollovers take place when people change jobs and wish to move 401(k) or 403(b) assets into an IRA, but IRA rollovers also happen when retirement savers want to switch to an IRA with better benefits or investment choices.

There are different types of IRA rollovers: direct and indirect. It’s crucial to follow Internal Revenue Service (IRS) rules to avoid paying taxes and penalties.

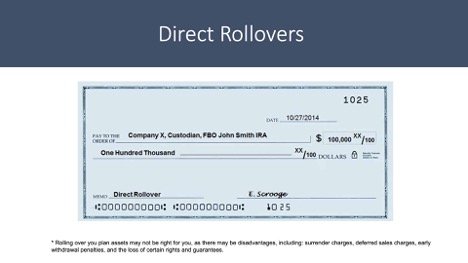

Direct Rollover

A direct rollover occurs when funds are moved between different plan types and are directly issued from the source plan to the receiving plan. The most common example is a rollover from a former employer 401(k) or other qualified plan to an IRA.

Because the funds are not distributed to the account holder, but rather to the receiving plan, there is no tax implication, and no tax withholding is required.

It is common for 401(k) and pension administrators to issue a rollover check to the new plan, but mail the check to the account holder, who then must forward the check to the receiving IRA custodian. Even though you might “handle” the funds, they are not viewed as having been distributed to you.

There is no IRS limit on the number or frequency of such direct rollover transactions. However, many 401(k) and pension administrators have their own policies limiting the number of rollovers you can execute per year or may require that you rollover all funds and close your account in certain situations.

Indirect Rollover (60-Day Rollover)

An indirect rollover is a process whereby funds are distributed from the source plan to the account holder and then deposited to a new retirement account within 60 days. Because of the initial distribution to the account holder, there are specific rules regarding such events that must be followed closely.

Failure to follow these rules will result in the amount being viewed as a taxable distribution with the addition of a 10% penalty for taxpayers under age 59 1/2. Funds absolutely must be deposited into a qualified retirement plan before the 60-day period expires. They can be deposited to the source plan, a new plan, or a different existing plan.

The tax treatment of the receiving plan should generally be the same as the source plan, though it is possible to combine a rollover from a tax deferred account with a conversion to Roth status.

Some source accounts – namely most qualified plans – will require that 20% be withheld for taxes. This really complicates the process of re-depositing funds, as you will need to come up with that 20% out-of-pocket and will then get it back at tax time.

IRS rules limit such indirect or 60-day rollovers to one such transaction per taxpayer per 12-month period.

Taxes for Rollover IRAs

2 Rules to Know

If you do a direct rollover, you’re good to go. No taxes to consider until you start withdrawing money in retirement. If you do an indirect rollover — that is, you receive a check made payable to you — then mind these rules so you don’t end up owing a big tax bill:

1. The 60-day rule

With an indirect rollover, you have 60 days from the date you receive the distribution to get that money into an IRA. If you miss that deadline, the IRS will likely deem this an early withdrawal, which means that in addition to income tax, you could owe a 10% early withdrawal penalty.

2. Taxes are withheld

With an indirect rollover from a workplace retirement plan, usually the check you receive will be for the amount of your 401(k) balance minus 20%. The plan administrator withholds the 20% to pay taxes on your distribution. (If you have a traditional 401(k) and you want to rollover into a Roth IRA, you will need to pay additional taxes, unless your money was in a Roth 401(k).)

To get your money back, you must deposit into your IRA the complete account balance — including whatever was withheld for taxes.

Contributions to Rollover IRA

Yes. However, in 2021 and 2022, contributions are limited to $6,000 per year ($7,000 if you're age 50 or older). If you chose a Roth IRA for your rollover, your ability to contribute may be further restricted based on your income.

Your ability to deduct traditional IRA contributions from your taxes each year may be restricted if you or your spouse has access to a workplace retirement plan and you earn over a certain threshold.

Rollover IRA Alternatives

Advantageous as the rollover IRA can be, you do have three other options:

Leave your money in your former employer's 401(k) - Of course, this is the simplest course. And if you have a robust plan with lots of fund choices that's performing well, why change it?

Roll the money into your new employer's 401(k) - "If someone is young and working with a small balance, rolling the old retirement funds into the new employer's plan can make a lot of sense," says Davis. "This often reduces fees, ensures the person is prudentially invested and consolidates accounts versus having small accounts scattered at various firms."

Cash out your account - In general, it's not a good idea to empty and close your 401(k). If you do, your employer will withhold 20% for income taxes, and you may owe a 10% penalty — unless you are older than 59 ½ or qualify for an exception.

Bottom Line

In transferring the funds, a direct rollover — with the retirement plan administrator directly depositing the money into the IRA is the preferred way to go. Since you don't ever touch the funds, you can't make a costly mistake.

Keep in mind that you do have some time to weigh your options. According to FINRA, the government-authorized overseer of broker-dealers, "By law, you must have at least 30 days to decide what to do with your 401(k) when you switch jobs."

So, take the time to choose carefully — after all, your retirement nest egg is at stake. Consult with a financial advisor or financial planner before making any decisions.

Making a smart decision now helps ensure you will be adequately prepared for a comfortable retirement.

Sources:

https://www.businessinsider.com/personal-finance/what-is-a-rollover-ira#what-is-a-rollover-ira?

https://ira123.com/learn/rollover-transfer/

https://www.nerdwallet.com/article/investing/how-to-rollover-401k-roth-traditional-ira

https://www.investopedia.com/terms/r/rollover-ira.asp

Disclosures:

This site may contain links to articles or other information that may be on a third-party website. Advisory Services Network, LLC is not responsible for and does not control, adopt, or endorse any content contained on any third-party website.

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.