Repayment Assistance Plan: 2025 Student Loan Changes

January 5, 2026

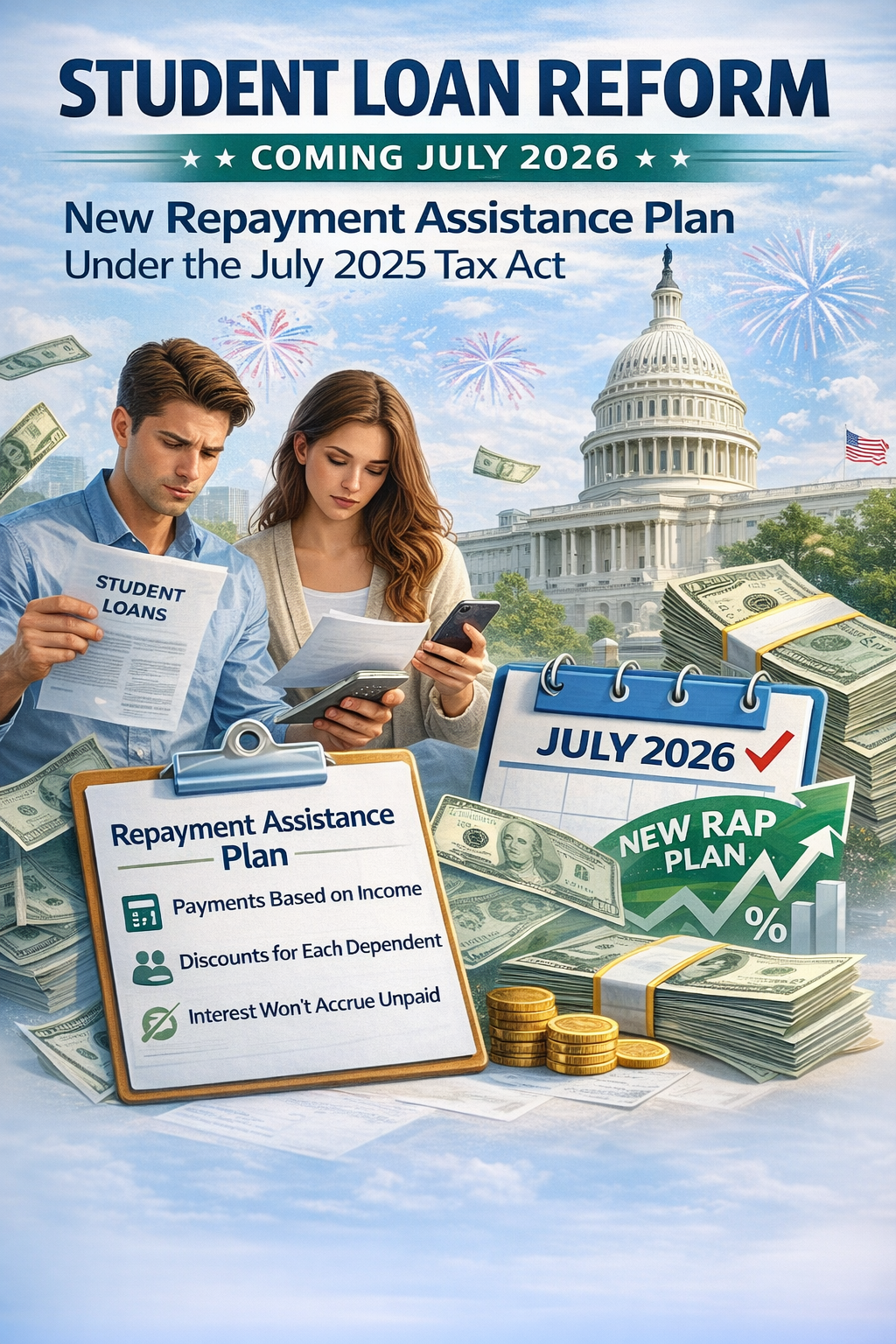

Income-based student loan repayment is undergoing a significant reset following the tax legislation signed on July 4, 2025. A centerpiece of this change is the creation of the Repayment Assistance Plan (RAP), a new income-driven repayment option scheduled to launch by July 1, 2026. For borrowers currently using income-driven plans—or planning to in the future—these changes could materially affect monthly payments and long-term repayment timelines.

What is the Repayment Assistance Plan (RAP)?

The Repayment Assistance Plan is a new federal income-driven repayment (IDR) option for student loan borrowers. Like earlier IDR plans, RAP ties required monthly payments to a borrower’s income and family size rather than the size of the loan alone. Once implemented, RAP will replace several existing programs, including the SAVE Plan, Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE).

How RAP is structured

Under RAP, borrowers generally pay a set percentage of their income each month toward their student loans. One notable feature mirrors the SAVE plan: any unpaid interest is eliminated each month, provided the borrower makes their required payment. As a result, balances do not grow simply because payments are too low to cover interest.

For example, if a borrower accrues $200 in monthly interest but qualifies for the minimum RAP payment of $10, that $10 is applied to interest and the remaining $190 is forgiven—not capitalized. This prevents negative amortization, a common issue under older repayment models.

Additionally, if a borrower’s required payment would reduce the loan balance by less than $50 per month, the Department of Education will contribute enough to reach that $50 reduction threshold. This feature is designed to ensure progress toward repayment even at low payment levels.

RAP allows up to 30 years for repayment before forgiveness, regardless of whether the debt stems from undergraduate or graduate studies. This is longer than prior IDR plans, which typically capped forgiveness at 20 years for undergraduate loans and 25 years for graduate loans.

How monthly payments are calculated

RAP payments are based on a borrower’s adjusted gross income (AGI), which reflects total income after certain deductions. These deductions may include retirement contributions, health savings account contributions, student loan interest, and health insurance premiums for self-employed individuals.

Household size also matters. Each dependent claimed on a tax return reduces the monthly payment by $50. For instance, a borrower with an AGI of $101,000 and no dependents would owe approximately 10% of income annually—about $842 per month. With two dependents, that payment would drop to roughly $742 per month.

Regardless of income or family size, RAP enforces a minimum payment of $10 per month.

RAP income tiers

Annual payment requirements scale with income as follows:

● $10,000 or less: $120 annually

● $10,001–$20,000: 1% of AGI

● $20,001–$30,000: 2%

● $30,001–$40,000: 3%

● $40,001–$50,000: 4%

● $50,001–$60,000: 5%

● $60,001–$70,000: 6%

● $70,001–$80,000: 7%

● $80,001–$90,000: 8%

● $90,001–$100,000: 9%

● Over $100,000: 10%

Who qualifies for RAP?

Borrowers with federal Direct Loans will be eligible for RAP once it becomes available, with one major exception: Parent PLUS loans do not qualify. Some borrowers holding non-Direct federal loans may be able to consolidate into a Direct Loan to gain access.

RAP versus the Standard Repayment Plan

Beginning July 1, 2026, new federal student loan borrowers will have only two repayment choices: the Standard Repayment Plan or RAP.

The Standard Repayment Plan uses fixed monthly payments over a predetermined timeline, similar to a traditional installment loan. Repayment length depends on the total amount borrowed:

● Less than $25,000: 10 years

● $25,000–$49,999: 15 years

● $50,000–$99,999: 20 years

● $100,000 or more: 25 years

Advantages of RAP

RAP offers several potential benefits compared to standard repayment:

● Payments adjust to income, helping align obligations with cash flow

● Loan balances do not grow due to unpaid interest

● Borrowers receive payment reductions for dependents

● Minimum payments ensure affordability while still reducing principal

Potential drawbacks to consider

There are also trade-offs:

● Repayment may extend up to 30 years, increasing the duration of payments

● Parent PLUS loans are excluded from RAP eligibility

● Borrowers accustomed to $0 minimum payments under prior IDR plans will face a $10 monthly floor

Frequently asked questions

When does RAP begin?

Current law schedules RAP to launch on July 1, 2026.

Which loans qualify?

Only federal Direct Loans are eligible. Parent PLUS loans are excluded.

What is the lowest possible payment?

The minimum monthly payment under RAP is $10.

When does loan forgiveness occur?

Loans are forgiven after 30 years of qualifying payments. Public Service Loan Forgiveness (PSLF) remains unchanged, allowing eligible borrowers to receive forgiveness after 120 qualifying payments.

Key dates to remember

● July 1, 2026: RAP becomes available

● Loans issued after this date will no longer qualify for SAVE, PAYE, or ICR

● New borrowers will choose between RAP and the Standard Repayment Plan

Bottom Line

The Repayment Assistance Plan represents a meaningful shift in how federal student loans will be repaid going forward, placing greater emphasis on affordability, balance stability, and long-term progress toward forgiveness. While RAP introduces valuable protections against interest growth and adjusts payments based on income and family size, it also extends repayment timelines and limits options for certain borrowers. As the July 1, 2026 rollout approaches, understanding how RAP fits into your broader financial plan will be essential to making informed borrowing and repayment decisions.

Sources:

https://www.fidelity.com/learning-center/personal-finance/repayment-assistance-plan

Disclosure:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This material is provided as a courtesy and for educational purposes only.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.