What a Government Shutdown Could Mean for Your Money

October 1, 2025

After weeks of debate in Congress with no funding deal in sight, the federal government is officially in shutdown mode. That means many “nonessential” government operations are on pause, while core services like Social Security payments, Medicare, Medicaid, air traffic control, and postal services continue as usual.

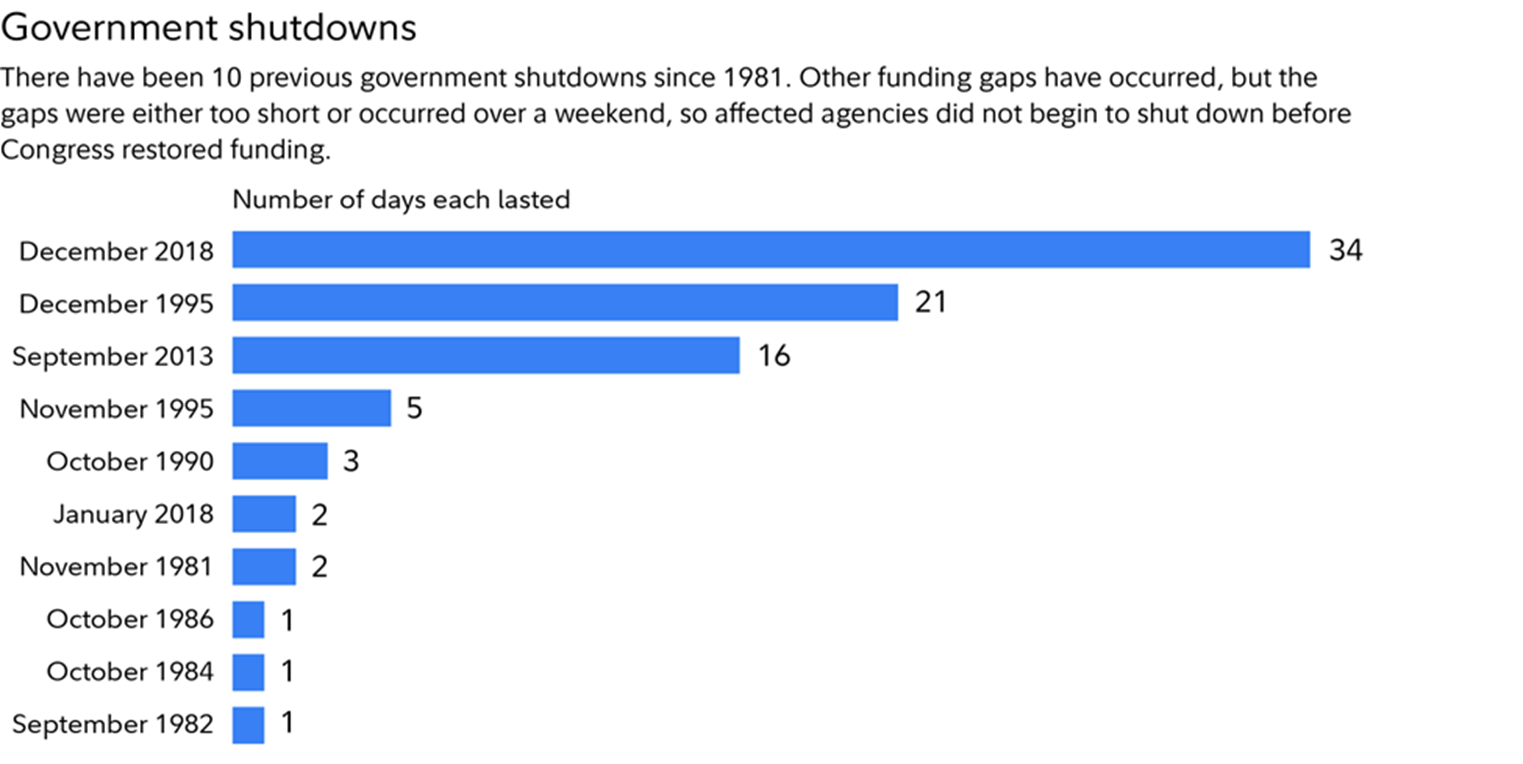

If this sounds familiar, it’s because shutdowns are nothing new. Since 1981, the government has shut down 11 times, ranging from a single day to the record-setting 34-day closure in 2018. While shutdowns can grab headlines and create short-term uncertainty, history suggests they rarely cause lasting damage to the economy or the markets.

So, should investors be worried this time around? Let’s break it down.

Source: US House of Representatives

Do Shutdowns Move the Stock Market?

Looking at past shutdowns, the answer is mostly “no.” Even the longer disruptions of 2013 and 2018 didn’t derail the stock market. In fact, research on S&P 500 performance during those periods shows that stocks often gained ground in the 100 days following the end of a shutdown.

Part of the reason is that markets focus on fundamentals—corporate earnings, economic growth, and interest rates—rather than short-lived political drama. As one market strategist put it, “We’ve seen this movie before, and it always ends the same way.”

That doesn’t mean you won’t see some volatility in the near term, but for long-term investors, these episodes have historically been little more than noise.

Sources: FMR, Bloomberg

What About Bonds and Fixed Income?

Unlike a debt ceiling crisis—where the government risks defaulting—a shutdown doesn’t stop the Treasury from paying its bills or holding bond auctions. Money market funds tied to Treasurys are also unaffected.

That said, some investors could use the shutdown as a way to show displeasure with fiscal policy by selling Treasurys, which might create temporary volatility. And if the closure drags on, companies that depend heavily on federal contracts could see pressure on their bond prices.

Could the U.S. Credit Rating Be at Risk?

This may be one of the bigger long-term risks. Credit rating agencies are less forgiving of repeated shutdowns and fiscal gridlock. Moody’s already issued a downgrade earlier this year, and more could follow if Washington continues on this path.

Why does that matter? Lower credit ratings can raise borrowing costs for the government, push up interest rates, and ripple into the broader financial system—effects that could last long after the shutdown ends.

What’s the Economic Impact?

On its own, a shutdown isn’t likely to trigger a recession. But the longer it continues, the greater the economic drag. The government is a major driver of spending, purchasing, and contracting. A prolonged halt in some of that activity can ripple through the economy.

There’s also the human side: hundreds of thousands of federal employees and contractors may miss paychecks. That not only hurts families directly but also weighs on consumer spending and confidence.

Should Investors Change Their Plans?

Probably not. While the headlines may sound alarming, the biggest danger for most investors is overreacting. If you already have a financial plan tailored to your goals and risk tolerance, chances are you don’t need to make any sudden moves.

If you don’t have a strategy in place—or if market swings make you uneasy—this might be a good time to revisit your portfolio with a financial professional. The goal is to stay focused on long-term growth rather than short-term politics.

Bottom line

Government shutdowns can be disruptive, but history shows they’ve had little lasting effect on markets. Staying disciplined, diversified, and focused on your personal goals remains the best strategy when Washington makes headlines.

Sources:

https://www.fidelity.com/learning-center/trading-investing/government-shutdown

Disclosure:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This material is provided as a courtesy and for educational purposes only.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.