What are your choices for an old 401(k)?

February 20, 2026

The savings you’ve built in your workplace retirement plan can play a major role in funding your life after work. Because these dollars are meant to support you for decades, decisions about an old 401(k) deserve careful thought.

If you’ve changed jobs, it’s worth slowing down before taking action. Review the available paths for your former employer’s plan and weigh which option best aligns with your goals, tax situation, and timeline.

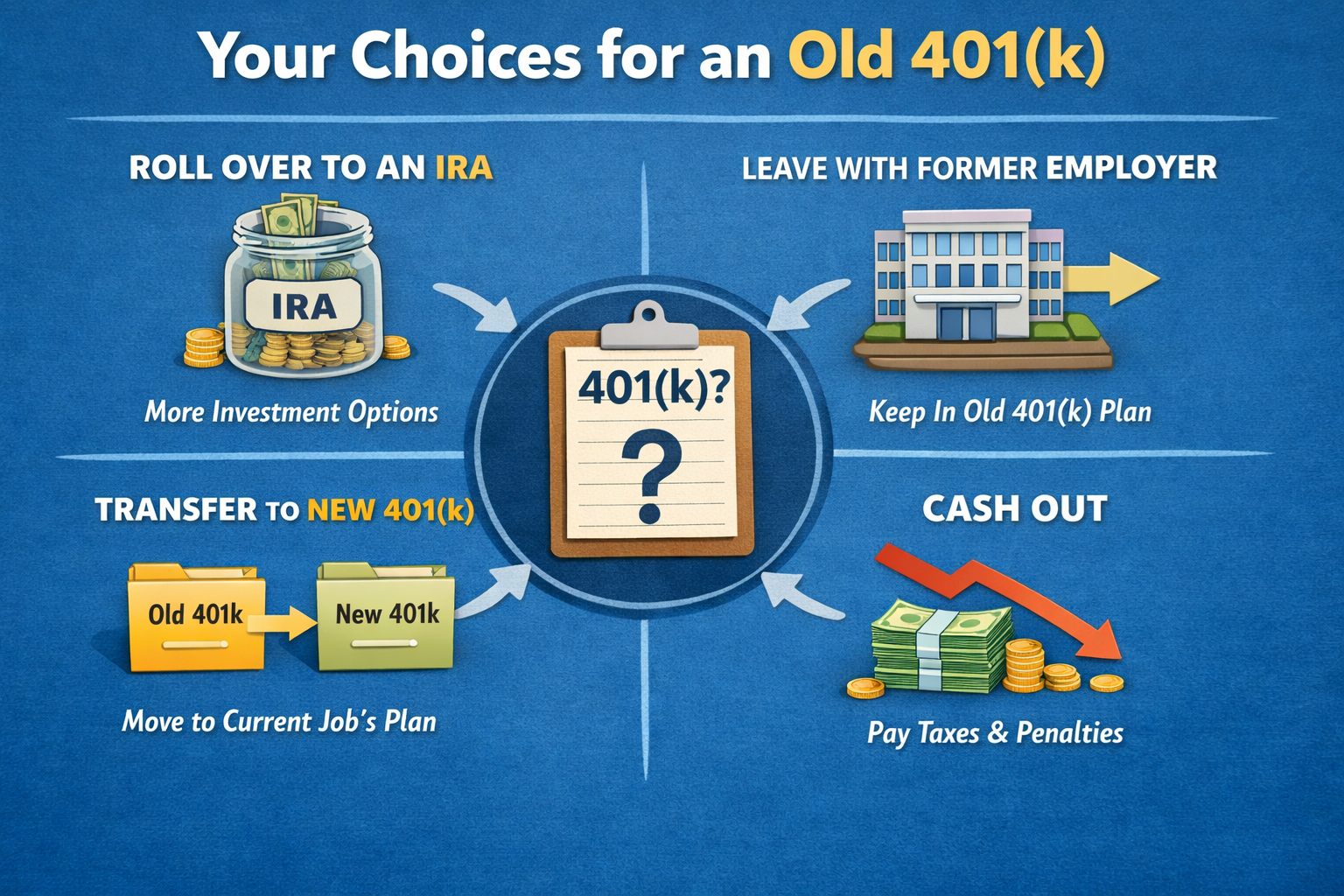

In most cases, a 401(k) from a previous employer can be handled in one of four ways:

● Keep the balance in your former employer’s plan, if permitted

● Move the funds into your new employer’s retirement plan, if allowed

● Roll the account into an individual retirement account (IRA)

● Withdraw the money and close the account

Not every plan allows every option. For example, if your balance falls within a certain range—often between $1,000 and $7,000—your former employer may require you to move the money. Checking directly with the plan administrator will clarify what’s available to you.

Understanding rollover and withdrawal tax rules

If you transfer your savings into an IRA, taxes will depend on the type of account. Withdrawals from a traditional IRA are generally taxed as ordinary income. With a Roth IRA, qualified withdrawals of earnings can be taken federal tax-free, as long as at least five years have passed since your first contribution and you meet age or eligibility requirements, such as being 59½ or older or qualifying under specific exceptions.

Cashing out a 401(k) is often viewed as a last resort. Early withdrawals typically trigger income taxes on pre-tax contributions and earnings, plus a 10% IRS penalty if you’re under age 59½. One notable exception applies if you leave your job in or after the year you turn 55—under this rule, certain distributions may avoid the penalty, though taxes still apply.

Even for retirees already past age 59½, keeping assets in tax-advantaged accounts can help extend the longevity of retirement savings.

Key questions to guide your decision

1. What investment options are available?

Retirement accounts vary widely in the choices they offer. Many employer-sponsored plans provide a curated lineup of investments, often mutual funds selected by the plan sponsor. Some plans include institutional or lower-cost funds that aren’t available elsewhere, or employer stock that may not be transferable outside the plan.

If your account holds company stock eligible for special tax treatment under net unrealized appreciation rules, rollover decisions become more complex and may warrant guidance from a tax professional.

While some investors find workplace plans restrictive, others include brokerage windows that expand investment flexibility. IRAs generally offer the broadest range of choices, including mutual funds, ETFs, stocks, and bonds. The right home for your money should support how you want to invest.

2. What are the costs?

Fees can vary meaningfully and deserve close attention. Common categories include:

● Account fees: Some workplace plans charge recordkeeping or maintenance fees, while IRAs may have custodial or trustee fees.

● Investment expenses: Expense ratios and fund costs can significantly affect long-term returns. Employer plans sometimes offer lower-cost institutional options.

● Advisory fees: Managed accounts or professional advice typically add another layer of cost on top of investment expenses.

Understanding the full fee picture can help you avoid unnecessary drag on your returns.

3. What services or protections matter to you?

Many retirement accounts come with planning tools, educational resources, or professional management options. Some services—such as checkwriting or wire transfers—may not be available in certain retirement accounts.

Creditor protection can also be a factor. Assets held in employer-sponsored retirement plans often receive stronger protection than those in IRAs, depending on state and federal rules.

4. When will you need the money?

Withdrawal rules differ between workplace plans and IRAs. For instance, some employer plans allow you to delay required minimum distributions (RMDs) while you’re still working.

● If you expect to work beyond age 73, rolling funds into a current employer’s plan could help postpone RMDs.

● If you leave a job at age 55 or later, keeping money in that employer’s plan may allow earlier, penalty-free access under the Rule of 55.

Timing can be just as important as taxes when deciding where your money should live.

5. How important is simplicity?

Consolidating retirement accounts can make it easier to monitor investments, compare fees, and manage withdrawals. If you’ve accumulated multiple old workplace plans, rolling them into a single account—either an IRA or a current employer’s plan—may streamline your financial life.

6. What if you’re self-employed?

If you own a business or work for yourself, you may be able to roll an old 401(k) into a small-business retirement plan, such as a SEP IRA. Depending on income, these plans can allow for substantial tax-advantaged contributions each year.

One size doesn’t fit all

The best choice for an old 401(k) depends on your personal circumstances, including investment preferences, fees, access needs, and long-term plans. Taking the time to evaluate all available options—and their costs—can help ensure your retirement savings continue working effectively for you.

Sources:

https://www.fidelity.com/viewpoints/retirement/rollover-questions

Disclosure:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This material is provided as a courtesy and for educational purposes only.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.