Hidden Risk of Rollovers: No Investment Strategy

December 30, 2025

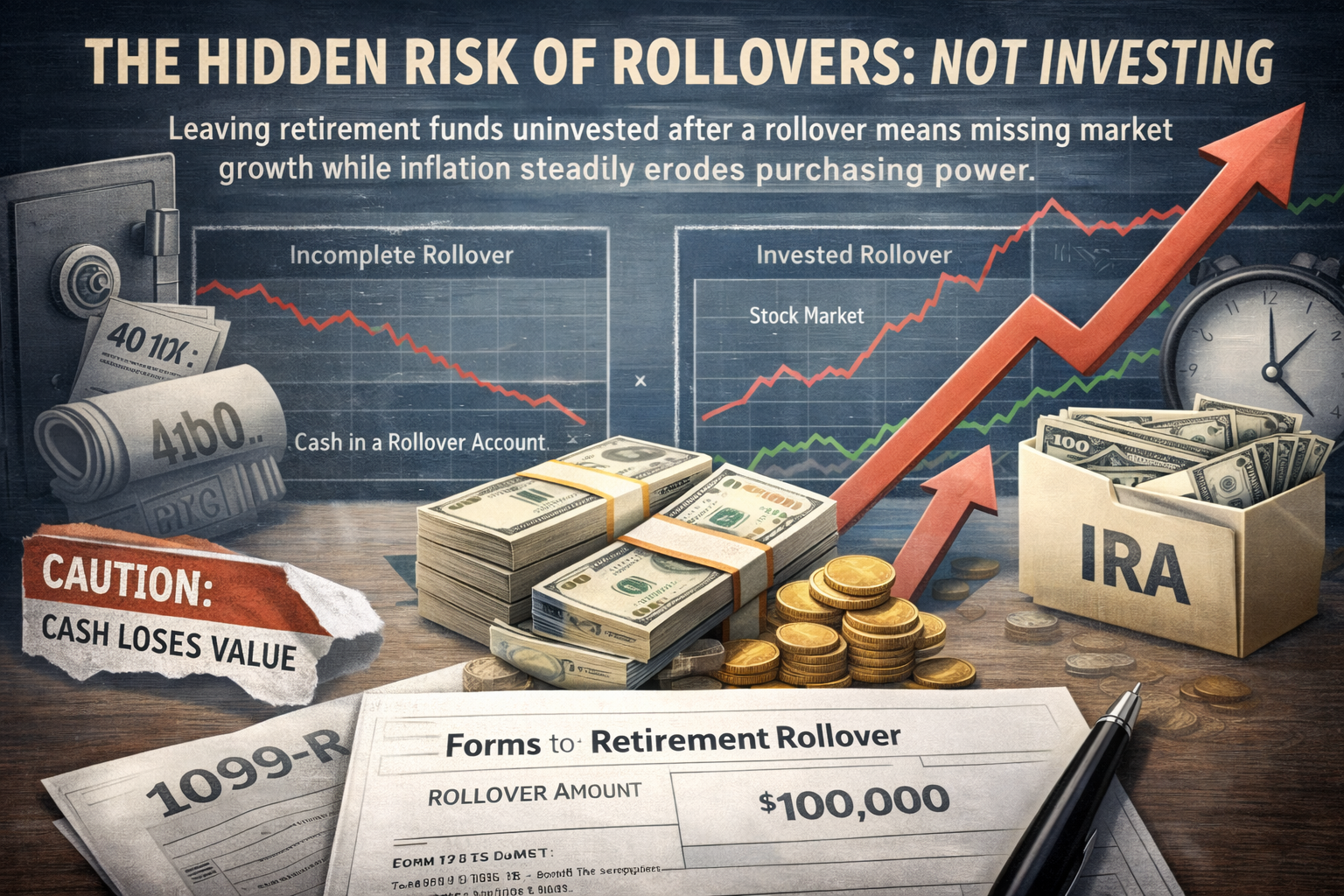

Each year, millions of Americans move retirement savings from employer plans like 401(k)s into IRAs. What many do not realize is that, after the rollover is complete, a portion of that money may end up parked in cash—and stay there far longer than intended. When that happens, years of potential growth can be lost as inflation steadily erodes purchasing power. Completing a rollover is not the end of the process; it is the beginning of a new phase of retirement decision-making.

Recent studies highlight how common this issue has become. Research conducted in 2023 and 2024 found that a significant number of rollover IRA investors left their assets uninvested for extended periods, often unintentionally. Nearly seven in ten investors who remained in cash reported that they did not understand how their IRA was invested. In many cases, the problem was not risk aversion, but simple confusion—confusion that can quietly undermine long-term compounding.

What actually happens during a rollover

One of the most misunderstood aspects of a 401(k)-to-IRA rollover is what happens to existing investments. In many cases, the holdings inside a workplace plan are liquidated during the transfer. The proceeds arrive in the IRA as cash rather than as invested assets. Unless the account owner selects new investments—or enrolls in a managed solution—that cash generally remains idle, aside from earning modest interest.

This surprises many people. There is an assumption that the transition will be seamless and automatic, but IRAs do not function like employer-sponsored plans. There is no default investment option, and no automatic reallocation. The next step requires action.

Many investors believe they remain invested after a rollover when, in reality, they are starting from scratch. Employer plans can default participants into investments under federal rules; IRAs cannot. During job transitions, investment decisions often take a back seat to more immediate priorities, making it easy to delay the follow-up.

For those who liked their former 401(k) allocation, documenting it before the rollover—by printing or saving a screenshot—can make it easier to recreate a similar mix in an IRA, even if the exact funds are not available.

Where uninvested money typically sits

Within an IRA, uninvested funds are held in what is known as a “core position.” This functions as a temporary holding account for cash and transactions and is often a money market fund or an FDIC-insured sweep option. While this cash position serves an important purpose, it is not designed to be a long-term strategy. Moving from cash into an investment approach aligned with your goals is the critical next step.

Why leaving money in cash can be costly

A rollover IRA may represent decades of work and saving, concentrated into a single transfer. Leaving those assets uninvested introduces meaningful risks:

● Lost growth potential: Over long periods, diversified portfolios have historically outperformed cash, meaning idle funds miss market participation.

● Inflation risk: Even when cash yields appear attractive, inflation can reduce real purchasing power over time.

● Planning drift: Without an intentional investment strategy, retirement goals can gradually slip out of reach.

Planning before investing

A rollover creates a natural opportunity to step back and reassess your overall retirement plan—especially if it has been years since you last reviewed it. Goals evolve, markets change, and assumptions made earlier in your career may no longer apply.

Davin notes that some of the most meaningful rollover conversations begin with planning rather than fund selection. In one case, a long-tenured employee discovered she was closer to retirement than she expected once her accounts were aligned with a clear strategy. By the time her rollover was complete, she already had a plan for emergency savings, income, and long-term growth.

A solid plan can clarify where you stand, what adjustments are available, and how each decision affects your outcome. It helps:

● Define your time horizon and income needs

● Align investment risk with real-world goals

● Coordinate multiple accounts into one cohesive strategy

● Turn intentions into actionable steps

Once you understand your position relative to your goals, the path forward becomes clearer. Personal finance blends data with behavior—the math may show what is required, but success depends on choosing an approach you can realistically maintain.

Completing the rollover process

After your funds arrive, a few final steps can help ensure nothing is left unfinished:

● Confirm the rollover is complete and funds are available to invest

● Decide whether to manage investments yourself or delegate to a professional

● Select an allocation that balances growth with your comfort during market volatility

● Automate contributions and investing when possible

● Schedule periodic reviews to adjust for life changes and market conditions

Practical rollover considerations

Whenever possible, a direct rollover—where funds move straight from the plan administrator to the IRA provider—can reduce paperwork, avoid withholding, and limit risk. If you receive funds personally, the IRS 60-day rule applies, and missing that deadline can trigger taxes and penalties.

An IRA’s flexibility can be a benefit, but it can also feel overwhelming. You may not need to reinvent your entire strategy. If a target-date or balanced approach worked well before, similar options may still be appropriate.

Cash feels safe—but carries its own risks

Holding cash can provide comfort, but as a long-term retirement strategy it can fall short. Without growth, portfolios may struggle to keep pace with inflation or support future income needs. While outcomes are never guaranteed, investing provides the opportunity for long-term growth that cash alone cannot offer.

For those hesitant to invest all at once, maintaining a reasonable cash reserve for emergencies while investing retirement assets according to plan can offer a balanced approach.

When professional help makes sense

If selecting and monitoring investments feels daunting—or simply not worth your time—working with a financial advisor can add value. Olde Raleigh Financial Group helps ABCA members integrate accounts, translate goals into a sustainable plan, and build an investment mix designed to hold up through market cycles.

ABCA members receive a complimentary consultation. Contact us today to get started.

www.olderaleighfinancial.com

919-861-8212

haden.jennings@olderaleighgroup.com

Sources:

https://www.asppa-net.org/news/2024/8/biggest-401k-rollover-mistake/

Disclosure:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This material is provided as a courtesy and for educational purposes only.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.