SECURE 2.0: Key Retirement Changes You Should Know

December 29, 2025

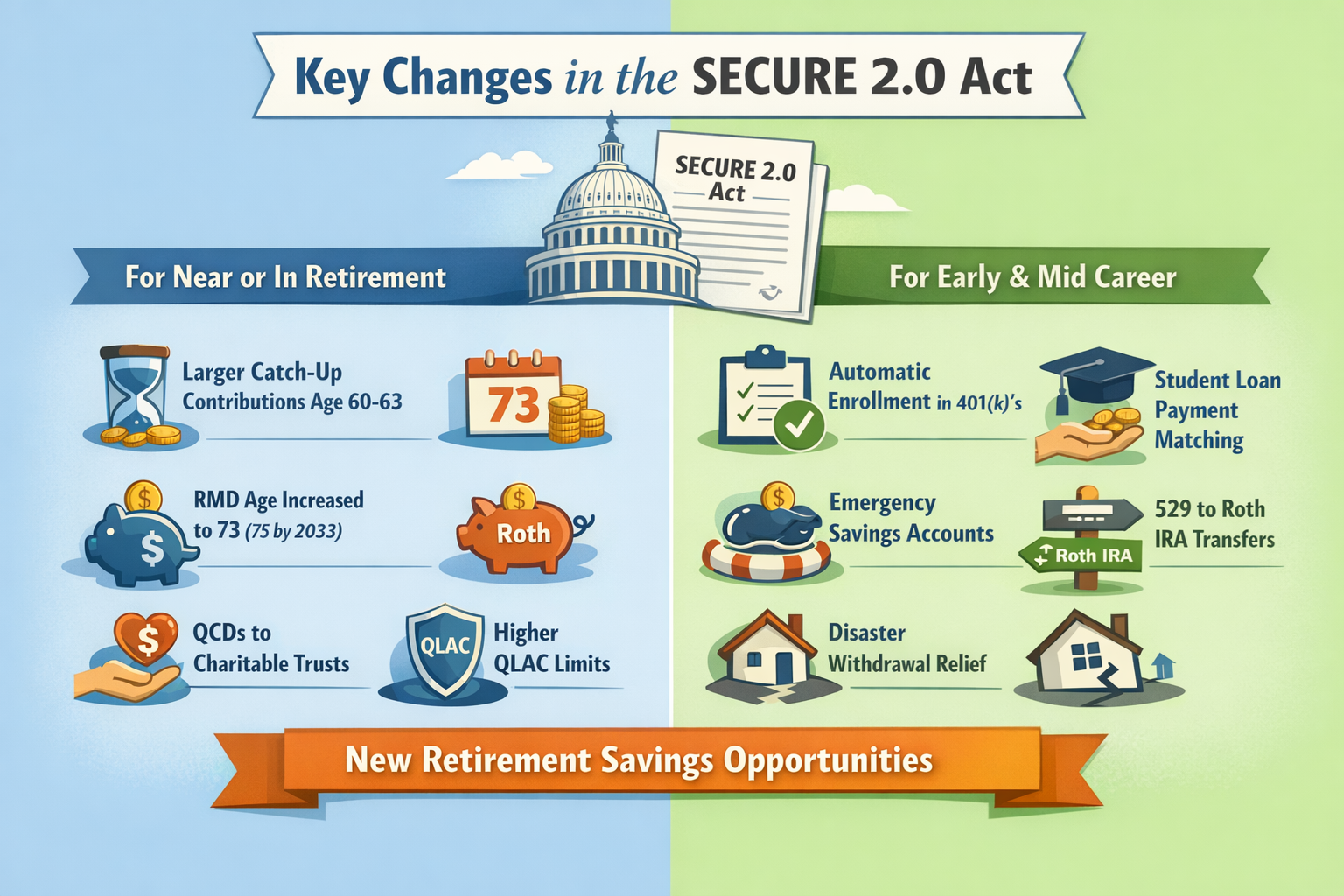

The SECURE 2.0 Act represents one of the most significant updates to the U.S. retirement system in years. Building on earlier reforms, the legislation introduces a wide range of changes designed to help Americans save more effectively, reduce friction as they move between jobs, and improve financial readiness for retirement.

Previous retirement laws increased the age at which required minimum distributions (RMDs) begin and expanded access to annuities inside workplace plans. SECURE 2.0 goes further, refining contribution rules, modernizing plan features, and addressing challenges faced by workers at every stage of their careers—from student loan borrowers to retirees managing withdrawals.

Although the law includes dozens of provisions, the most impactful changes center on higher catch-up contributions, revised RMD rules, new Roth options, and expanded flexibility for emergency savings and disaster relief.

Below are 10 notable changes introduced under SECURE 2.0.

Changes That Matter Most for Those Near or in Retirement

1. Expanded catch-up contributions for ages 60–63

Beginning in 2025, workers who reach ages 60 through 63 during the calendar year can make enhanced catch-up contributions to eligible workplace retirement plans. The increased limit allows contributions of up to $11,250, replacing the standard $7,500 catch-up amount, provided the plan permits it.

Starting in 2026, a new rule applies to higher earners: individuals age 50 or older who earned more than $150,000 in the prior year must make catch-up contributions on a Roth (after-tax) basis. Those earning below that threshold—indexed for inflation going forward—are exempt.

For IRAs, the catch-up contribution remains $1,000 for individuals age 50 and older, but that amount will now be adjusted for inflation over time. It remains unchanged for 2025.

2. Required minimum distribution (RMD) rules updated

SECURE 2.0 continues the gradual shift toward later RMD start ages. As of 2023, RMDs begin at age 73, replacing the former age 72 threshold. Those who reached age 72 in 2022 or earlier must continue following their original RMD schedule.

Looking ahead, the RMD starting age will increase again—to 75—beginning in 2033.

The law also reduced penalties for missed RMDs. The excise tax dropped from 50% to 25%, and may be further reduced to 10% if the missed distribution is corrected and a revised tax return is filed within two years.

Additional RMD-related updates include:

● Roth accounts within employer retirement plans are no longer subject to RMDs starting in 2024

● Excess annuity payments from in-plan annuities may count toward satisfying annual RMD obligations

3. Employer matching contributions can go to Roth accounts

SECURE 2.0 allows employers to offer matching and profit-sharing contributions directly into Roth accounts, if the plan is designed to support it. Previously, employer matches were required to be pre-tax.

While adoption will take time due to administrative and payroll system updates, this change gives savers more flexibility to build tax-free retirement income.

4. Expanded charitable giving options through IRAs

Individuals age 70½ or older can continue using qualified charitable distributions (QCDs) to donate directly from an IRA. Beginning in 2024, SECURE 2.0 allows a one-time QCD—up to $54,000 in 2025, indexed for inflation—to certain split-interest charitable vehicles, such as charitable remainder trusts or charitable gift annuities.

This special QCD counts toward the annual QCD limit and can satisfy RMD requirements, provided the transfer is made directly from the IRA by year-end. Not all charities qualify, so careful planning is required.

5. Enhancements to longevity annuities

Qualified longevity annuity contracts (QLACs), which provide income later in life (typically by age 85), received several upgrades. The maximum premium limit increased to $210,000 in 2025, and the prior restriction limiting premiums to 25% of retirement account balances was eliminated.

These changes provide greater flexibility for retirees seeking to manage longevity risk and coordinate annuity income with RMD obligations.

Changes Focused on Workers Earlier in Their Careers

6. Automatic enrollment and portability

Starting in 2025, most newly established 401(k) and 403(b) plans must automatically enroll eligible employees at a minimum contribution rate of 3%. Contributions must also automatically escalate over time.

The law also enables retirement plan providers to offer automatic portability services, which move small retirement balances into a new employer’s plan when workers change jobs. This feature may reduce the likelihood of cash-outs that derail long-term savings.

7. Workplace emergency savings accounts

Defined contribution plans may now include a dedicated emergency savings account for non–highly compensated employees. These accounts are structured as Roth accounts and allow contributions of up to $2,500 annually, or a lower employer-set limit.

Participants can make up to four penalty-free withdrawals per year, and in some cases, employer matching contributions may apply. The goal is to help workers manage short-term financial shocks without tapping long-term retirement savings.

8. Student loan payment matching

Beginning in 2024, employers may treat qualifying student loan payments as if they were retirement plan contributions for purposes of matching. This allows employees burdened by education debt to receive employer retirement contributions even if they are unable to defer income into a retirement plan.

9. New flexibility for unused 529 plan funds

After a 529 plan has been open for at least 15 years, unused funds may be transferred to a Roth IRA for the designated beneficiary. Transfers are subject to annual Roth contribution limits and a lifetime cap of $35,000.

Only contributions made at least five years prior to the transfer are eligible, and transferred amounts count toward the beneficiary’s annual Roth IRA limit.

10. Expanded disaster-related retirement access

SECURE 2.0 broadened access to retirement funds following federally declared disasters. Eligible individuals may withdraw up to $22,000 with favorable tax treatment, including the option to spread income taxes over multiple years and potentially recontribute the funds.

Additional relief options may include enhanced plan loans or hardship withdrawals, depending on plan rules. While these provisions offer flexibility, withdrawals can still reduce long-term retirement growth and should be approached cautiously.

Final Thoughts

SECURE 2.0 introduces meaningful opportunities to strengthen retirement outcomes, but its impact varies based on age, income, employment status, and plan design. Understanding how these changes apply to your specific situation is essential.

Before making decisions, consider consulting a financial advisor or tax professional to ensure you are taking full advantage of the new rules while aligning them with your broader financial goals.

Sources: https://www.fidelity.com/learning-center/personal-finance/secure-act-2

Disclosure:

This information is an overview and should not be considered as specific guidance or recommendations for any individual or business.

This material is provided as a courtesy and for educational purposes only.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.